CRE Lending? Supercharge it.

This workflow is weakening your portfolio.

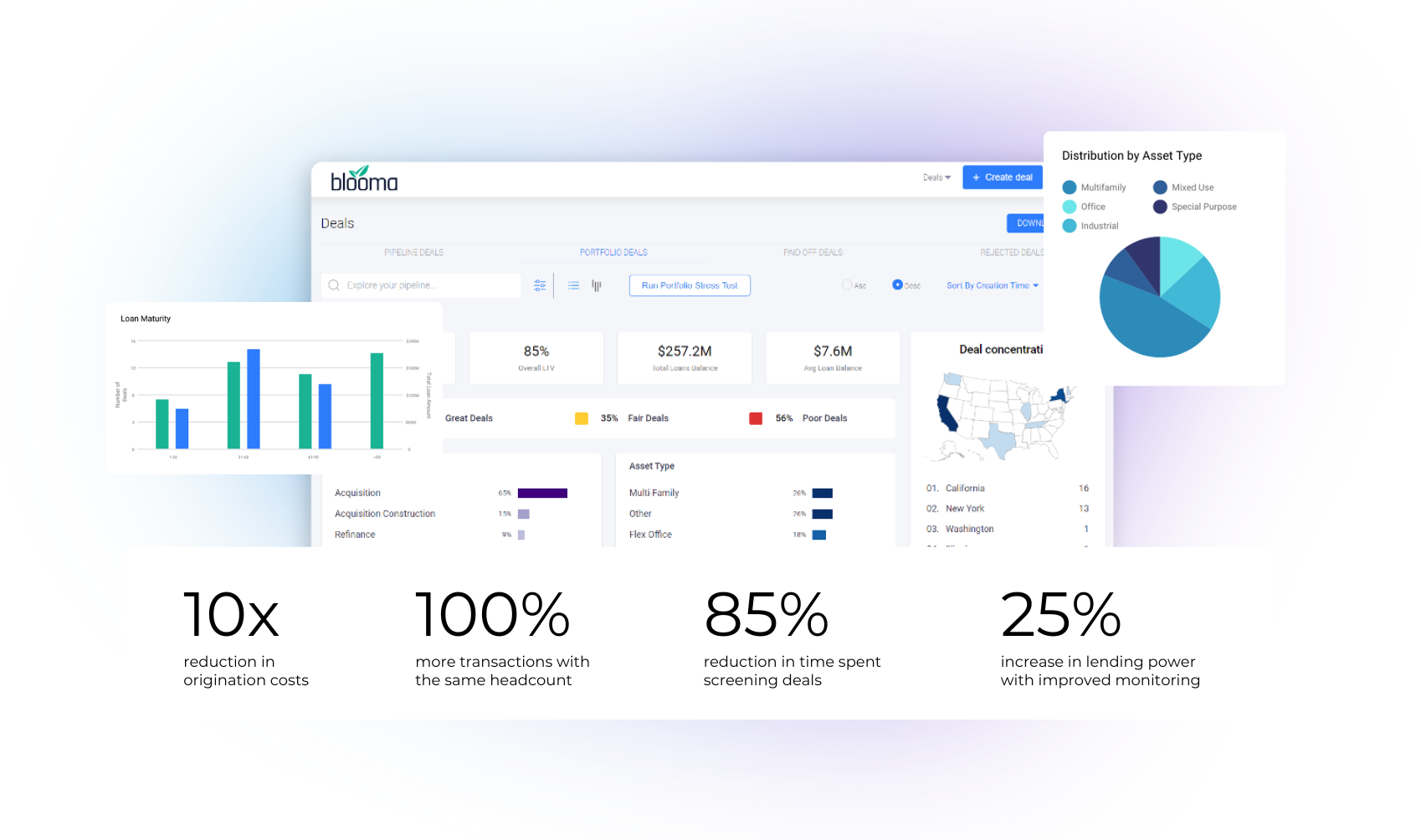

Disconnected processes lead to missed risks and lost opportunities. Blooma isn’t an LOS, CRM, or data provider—it’s the insights engine that augments your current tech stack, empowering smarter portfolio management.

.png)

Unlock the power of CRE Intelligence

Blooma is the missing link that connects your CRE tools, automates insights, and delivers real-time monitoring. Built specifically for lenders, CRE Intelligence integrates seamlessly into your existing tech stack, transforming raw data into actionable insights that elevate your decision-making and accelerate every step of the lending process.

.png?width=450&height=415&name=Blooma%20-%20Brand%20Guidelines%20(4).png)

.png?width=500&height=418&name=Blooma%20-%20Brand%20Guidelines%20(8).png)

The Blooma Advantage

Blooma empowers CRE lenders to work smarter and make faster, data-driven decisions. From seamless automation to real-time monitoring and enhanced connectivity, our platform is designed to elevate every step of your lending process.

Click the links to learn more about CRE Intelligence.

Smarter lending, every step of the way

In today’s fast-paced market, your success hinges on making smarter lending decisions with real-time insights. Blooma enhances every part of your process by automating critical insights, seamlessly connecting your data and tools, and delivering the intelligence you need to make faster, more confident decisions. Focus on growth, manage risks proactively, and turn complex data into actionable value—all while Blooma powers your lending process behind the scenes.

Automate

Boost efficiency by automating manual data entry and document processing, so you can focus on strategic decision-making.

Evaluate

Gain deep insights into your deals with real-time data, helping you assess risk and make more confident lending decisions.

Monitor

Stay informed with continuous portfolio monitoring and instant alerts, so you’re always ahead of potential risks.

Connect

Integrate effortlessly with your existing tech stack, creating a unified platform that streamlines your entire workflow.

See Blooma in action

Watch how Blooma automates, alerts, and empowers your team—so you can shift from busywork to building growth.

With CRE Intelligence, Blooma empowers you to:

Level Up Your Tech Stack

Connect and optimize your systems, allowing data to flow seamlessly from origination to portfolio monitoring.

Achieve New Levels of Efficiency

Automate repetitive tasks, reduce manual data entry, and free up your team to focus on strategic growth.

Enhance Real-Time Monitoring & Alerts

Stay informed with intelligent alerts and ongoing portfolio monitoring that keep you ahead of potential risks and opportunities.

Unlock Scalable, Data-Driven Growth

Let AI-powered insights guide your lending decisions, providing the clarity and confidence needed to grow with ease.

Tailored solutions for every team.

Blooma’s scalable solutions are built to fit the needs of CRE lenders of any size. Whether you’re a small team focused on origination or a large institution managing complex portfolios, Blooma adapts to your workflow.

.png)

BLOOMA PRO

For smaller teams needing streamlined origination tools, Blooma Pro delivers quick setup and essential automation to help you assess deals quickly and accurately and drive efficiency.

BLOOMA ENTERPRISE

Why CRE Lenders Choose Blooma

C3Bank has been able to spend more time on the right deals for our bank and automate our lending process – Blooma has transformed our lending business.

In this very turbulent CRE environment, Blooma has enabled us to stop managing our portfolio through the rearview mirror with annual review process, and start looking through the windshield where we see property values, cap rates and future cash flows adjust based on changing market dynamics.

Blooma’s automation platform changed the way we manage our loan origination process. We are now able to approve the right loans which has dramatically improved the profitability of our lending processes.

Break free from the status quo

Disconnected systems, manual data entry, and delayed insights are holding your team back. Blooma empowers CRE lenders with connected automation and real-time intelligence, letting you focus on growth—not busywork.

Connect and unify scattered systems

When data is scattered across systems, it’s impossible to get a clear, real-time view of your portfolio. Blooma brings everything together—integrating data from all sources into a single, streamlined platform for faster, smarter decision-making.

Automate and eliminate manual work

CRE lending workflows are often weighed down by tedious, manual tasks that slow your team’s productivity. Blooma’s AI-driven tools automate the heavy lifting, from data entry to deal analysis, so your team can focus on high-value work instead of repetitive processes.

Move from reactive to proactive decision-making

Quarterly reviews and periodic checks are no longer enough to stay ahead in today’s fast-moving market. Blooma’s real-time monitoring keeps you informed every step of the way, delivering continuous updates and alerts that enable proactive, data-driven decisions.

Simplify complexity and gain control

Managing complex portfolios shouldn’t mean losing control over your workflows. Blooma’s intuitive platform combines powerful automation with customizable settings, so you can tailor workflows to your needs and maintain control at every stage.