CRE Mortgage Lending Software

Commercial Mortgage Lending Software

Blooma leverages the power of artificial intelligence and machine learning to help lenders evaluate and process new deals faster than ever. Using our technology, you can rapidly scale your commercial real estate business while slashing operating costs.

Today’s CRE loan process is Manual and Tedious

If you’re among the 66% percent of executives still using legacy tools and workflows, you know that the commercial real estate lending process is drawn out, involving countless hours of data entry and other mundane tasks. Most lenders only close about 10% of the deals they screen – and that’s after months of effort. Yesterday’s underwriting methods can’t keep up with today’s real estate market.

A Fully Digital CRE Solution: Blooma’s Secret Weapon

Enter Blooma: The first fully digital, cloud-based commercial real estate lending solution. Our innovative tool:

- Automatically analyzes deal data from documents you upload into the system, eliminating manual entry and facilitating rapid lending decisions.

- Let's you export deal details into your existing underwriting template with a single click, expediting the loan origination process.

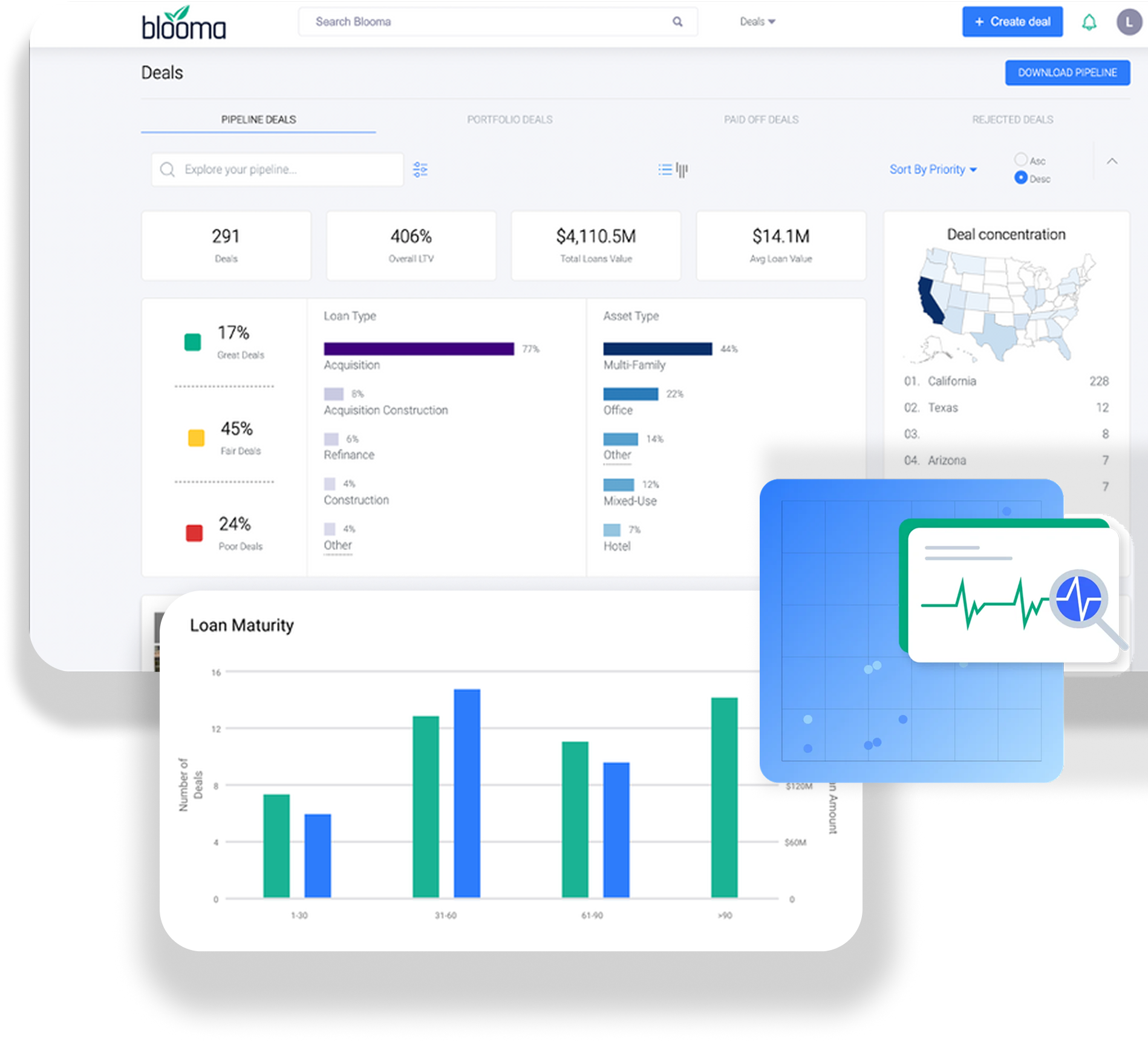

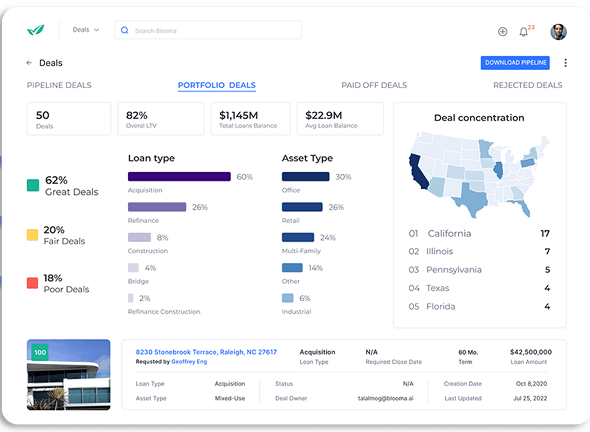

- Gives you a dashboard where you can monitor your entire portfolio, complete valuation modeling, and get the insight you need to grow your business.

The result? You’ll be able to see an average of three times as many deals and cut the time spent screening them by 85%.

CRE with confidence

Blooma empowers you to move away from the tedious aspects of the commercial real estate business and confidently step into the strategic, entrepreneurial side. Here’s how it helps you streamline the commercial mortgage process:

With Blooma, you won’t have to chase down the information you need or perform complex calculations. Instead, our commercial real estate software performs property, borrower, market, and financial analysis on every deal you run through it. Plus, it calculates six valuations per deal and shows you up to 100 comparable properties.

Blooma helps you quickly assess the risk for each deal. Our CRE solution lets you adjust variables such as revenue, expenses, cap rate, vacancy, and interest rate. Then, you can see the impact on the deal’s loan-to-value (LTV) ratio, debt service coverage ratio (DSCR), and debt yield.

Think of Blooma’s dashboard as your commercial real estate highlight reel. You can see all the deals you’re working on in real-time – and your current portfolio – in one place.

You’ll Love the Blooma Difference

Blooma is using technology to revolutionize commercial lending. Our CRE software will help you scale your real estate empire efficiently and profitably. Plus, Blooma plugs seamlessly into your existing tech stack so you won’t miss a single deal waiting on software implementation.

But don’t take our word for it. Schedule a demo today and see how Blooma can help your commercial real estate company bloom.

Explore Our Products

Frequently Asked Questions

Does Blooma support commercial real estate analysis?

Which types of documents does Blooma support?

How does Blooma automate the underwriting process?

What types of reports can Blooma create for my business?

Contact Us

Blooma is using technology to revolutionize commercial lending. Our CRE software will help you scale your real estate empire efficiently and profitably. Plus, Blooma plugs seamlessly into your existing tech stack so you won’t miss a single deal waiting on software implementation.

But don’t take our word for it. Schedule a demo today and see how Blooma can help your commercial real estate company bloom.

Book Your Demo!

Ready to Transform Your Commercial

Real Estate Portfolio?

Request a demo today to get started