What is the Commercial Real Estate Loan Process?

The commercial real estate loan process has several key steps to get financing for commercial properties like office buildings, shopping centers, or apartment complexes. Unlike residential mortgages, these loans are designed for businesses, investors, and developers.

The process requires evaluation of the borrower’s creditworthiness, the property’s income potential, and the overall risk of the loan.

A smooth loan process benefits both borrowers (business owners) and commercial lenders through timely funding and structured financial agreements.

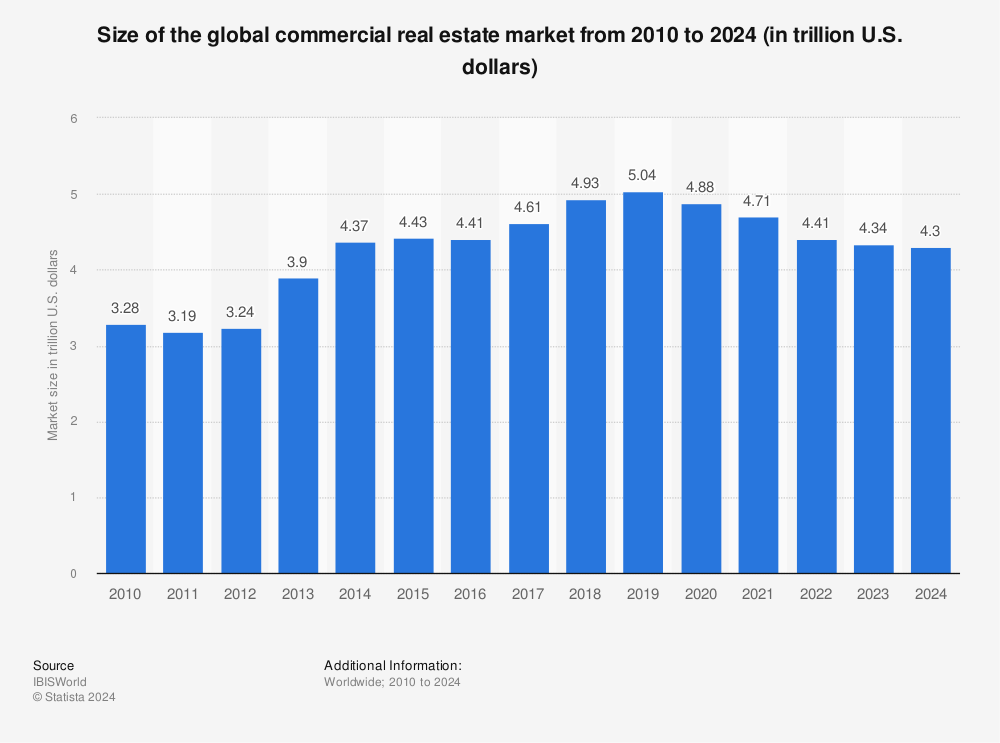

Did you know the commercial real estate market was worth well over $20 trillion last year? That’s a big chunk of the economy. So, you need to know how to navigate the loan process.

Source: Statista

In this post, we’ll cover the importance of commercial real estate loans, how commercial mortgage loans work from application to closing, what borrowers and lenders need to consider, credit history and credit rating, loan terms and cash flow, and how this can impact availing Small Business Administration/SBA loans, commercial bridge loans, and commercial hard money loans.

Let’s get into the comprehensive guide to the commercial real estate loan process and inform you how you can leverage Blooma in the process.

Key Stages in the CRE Loan Process

To navigate the commercial loan process with the best software, you need to know the key stages. These stages ensure both borrowers and commercial lenders are on the same page with the terms and viability of the loan.

Each stage is important to get a well-structured commercial mortgage loan, minimize risks, and set the stage for successful property investments. Here’s a breakdown of the main stages:

Loan Application and Pre-qualification

The borrower submits the commercial property loan application and supporting documents, financial statements, business plans, and income tax returns.

Pre-qualification is where the lender assesses the borrower’s creditworthiness and the loan-to-value ratio (LTV).

Property Appraisal and Valuation

An appraisal is done to determine the commercial property’s market value.

This step ensures the purchase price matches the property’s actual value for the benefit of both the borrower and the commercial real estate lender.

Due Diligence and Underwriting

During underwriting, lenders review the borrower’s credit history, cash flow, and the property’s income potential. The debt service coverage ratio (DSCR) is calculated to see if the borrower can cover loan payments.

Lenders also review all documents and verify everything during this stage.

Loan Approval and Documentation

Once underwriting is done, the lender gives loan approval.

Borrowers and lenders finalize loan terms, interest rates, repayment schedules, and prepayment penalties.

Loan Closing and Funding

The last stage is signing all documents, paying closing costs, and disbursing funds.

This also includes paying legal fees so the loan is ready for the borrower to purchase or refinance the commercial property.

Challenges in the Traditional CRE Loan Process

While the commercial real estate loan process is necessary to buy or refinance properties, traditional methods can be a big hassle that slows things down and increases risk.

- Time-Consuming: The process involves lengthy application procedures, delayed document reviews, and long underwriting times. This can be especially frustrating for borrowers looking for quick funding.

- Complex and Manual: Traditional lending involves manual data entry, lots of paperwork, and complex calculations. This is not only slower but also requires all parties to have deep financial knowledge.

- Communication Gaps: Borrowers, commercial real estate lenders, appraisers, attorneys, and other parties communicating with each other can cause miscommunication or missed deadlines. This lack of streamlined communication can slow things down and confuse.

- Potential for Delays and Errors: Manual data entry and human process reliance increase the chances of errors like mismatched numbers or incomplete documents. These errors can delay the loan approval and funding stages and hurt both borrowers and lenders.

The Role of Technology in Streamlining the CRE Loan Process

In an industry where manual processes and inefficiencies are the norm, technology has become the game changer for the commercial real estate loan process.

Here’s how CRE software is addressing the challenges:

- Automation: By automating tasks like data entry, document collection, and processing, technology reduces the time and effort required to complete these critical steps. This speeds up the process and minimizes human error.

- Digital Platforms: Modern digital platforms provide borrowers and lenders with a single place to submit applications, share documents, and communicate. These platforms increase transparency and coordination between all parties.

- AI and Machine Learning: New technologies like AI and machine learning are changing commercial lending by optimizing underwriting, predicting risk, and enabling data-driven decision-making. This makes it easier to qualify borrowers and value properties with greater accuracy and speed.

Benefits of a Faster Loan Process

A faster commercial real estate loan process through mortgage lending solutions and other tech tools benefits all parties.

Here’s how:

- Reduced Time to Close and Faster Access to Capital: Faster access means borrowers get funded sooner so they can grab commercial property deals without delay. This is especially true in competitive markets where time is of the essence.

- Improved Borrower Experience and Satisfaction: Simpler applications and shorter timeframes are better for business owners and other borrowers. A smooth process builds trust and satisfaction between borrowers and lenders.

- Increased Efficiency and Productivity for Lenders: Faster processing means commercial lenders can process more loan applications in less time and focus on higher-value activities like portfolio management and client engagement.

- Reduced Operational Costs for Both Borrowers and Lenders: Less manual work and fewer delays translate to cost savings for both borrowers and lenders in both administrative and operational expenses.

How Blooma Accelerates the CRE Loan Process

In the cutthroat world of commercial real estate, a faster and more efficient loan process can make all the difference.

Blooma’s new approach uses technology to turn the commercial real estate loan process on its head and delivers benefits for lenders and borrowers alike.

Here’s how Blooma can revolutionize your workflows:

- AI-Powered Underwriting and Risk Assessment: Blooma uses AI to automate the mundane and repetitive underwriting tasks to help make better risk assessment judgment on the human level.

- Digital Platform for Seamless Collaboration: With Blooma’s platform, stakeholders can share documents, communicate, and track loan progress in real-time. This eliminates communication gaps and improves collaboration between borrowers, appraisers, and commercial lenders.

- Automated Data Extraction and Analysis: Manual data entry is a big bottleneck in the CRE loan process. Blooma automates this task, reduces errors, and saves time so loans get approved faster and operations run smoother.

- Real-Time Insights and Reporting: Blooma gives stakeholders up-to-date information on loan status, property performance, and portfolio risk. This enables proactive decision-making and keeps everyone in sync.

Wondering what the proof is to back this up? Request a case study so you can see firsthand how we’ve made a difference.

By using Blooma’s AI and digital workflows, lenders can speed up the commercial mortgage loan process, improve borrower experience, and reduce operational costs to win in today’s fast-paced real estate market.

Streamline Your CRE Loan Process with Blooma

A smooth loan process is key to success for both borrowers and lenders. By reducing delays and errors and improving collaboration, a smooth loan process creates faster access to capital and higher satisfaction for all parties.

Technology can do this. AI, automation, and digital platforms can speed up decision-making, reduce operational costs, and make the CRE loan process more efficient.

Blooma is leading the way in commercial real estate with AI-powered solutions to simplify underwriting, risk assessment, and loan management.

With Blooma, lenders can close more deals, borrowers can have a smoother experience, and the whole process is more transparent and efficient.

Are you ready to elevate your loan process?

Find out how Blooma can transform your lending workflows.

Take the first step toward a faster, smarter, and more efficient CRE loan process with Blooma today!