For seasoned practitioners, commercial real estate—office, retail, industrial, and multifamily—represents a portfolio of income-producing assets designed for sophisticated capital deployment and value creation, a distinct investment class from residential housing.

CRE includes many property types, including but not limited to:

- office properties

- shopping centers and department stores

- data centers

- apartment buildings

- specialized properties like brownfield land or medical centers

These properties are broken down into four main categories: office, industrial, retail and multifamily.

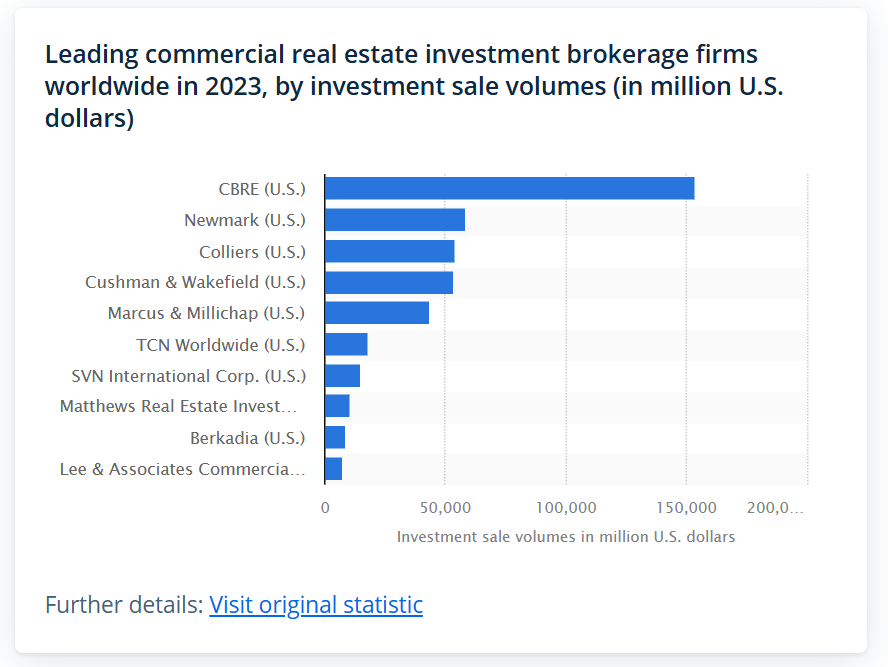

Commercial real estate is the backbone of the economy. In fact, the CRE market is worth over $4.5 trillion, driven by leasing, management, and development services.

Source: Statista

Its potential for capital gain and steady income makes it a great option for investors looking to diversify their portfolio.

In this article, we will cover the reasons why you should invest in commercial real estate, how to get started in CRE investing, and how commercial lending software can help.

Read on to get started!

Why Invest in CRE?

Investing in commercial real estate gives you the opportunity to build wealth and diversify your portfolio as commercial properties generate income with a steady flow and long term asset appreciation.

Here’s why CRE is popular with investors.

Potential High Returns

- Long Term Appreciation: Commercial properties tend to appreciate over time, providing big capital appreciation opportunities for investors. Property selection and market timing can add to returns.

- Steady Income: Rental income from office properties, retail properties, and multifamily properties can generate cash flow even in a downturn. This makes CRE a great option for those looking for a steady inflow of income.

- Tax Benefits: CRE investments have tax benefits, offering depreciation deductions which can offset taxable income and 1031 exchanges, which allow investors to defer taxes on property sales when reinvesting.

Diversification

- Reduce Portfolio Risk: By investing in asset classes other than stocks and bonds, CRE is a way to spread risk and reduce market volatility.

- Inflation Hedge: Unlike other investments, commercial real estate retains or appreciates during inflationary periods as property values and rental rates increase with inflation.

Control and Leverage

- Active Management: As a property owner, you have control over management decisions, leasing strategies, property management and development plans so you can impact the property’s performance.

- Leverage: CRE allows for a lot of leverage, you can use debt to finance properties and amplify returns on your investment.

Investing in CRE is great for your income, control over your portfolio, and long term growth. This applies to both seasoned and new investors.

Challenges and Risks of CRE Investment

While commercial real estate can be very rewarding, you have to consider the challenges and risks that come with this asset class.

Here’s what to look out for:

Market Fluctuations

- Economic Cycles and CRE: Commercial real estate is very economically driven. A downturn can mean reduced demand for office space, retail properties, or industrial buildings, and impact property values and rental income.

- Tenant Risk and Vacancy Rates: Relying on tenants for rental income can be risky if vacancies increase or tenants default on their leases, especially in less desirable locations or during market downturns.

High Initial Investment

- Significant Upfront Capital: Buying commercial properties requires a big upfront investment, which can limit smaller investors.

- Ongoing Management Costs: Managing office properties, shopping centers or multifamily properties involves ongoing costs like repairs, utilities, and property management fees.

Regulatory Compliance

- Zoning Laws, Building Codes and Tax Regulations: The regulatory environment can be tricky. From zoning restrictions and building codes to tax laws, investors must account for potential legal and administrative headaches.

Illiquidity

- Can’t Sell CRE Properties Quickly: Unlike residential real estate, commercial properties are less liquid, meaning it may take time to find buyers and close deals. This can be a problem if you need cash quickly.

Now that you know what to watch out for, you can make informed decisions and minimize the risks so your CRE journey is as rewarding as possible.

How to Get Started in CRE

Getting into commercial real estate requires planning, knowledge, and strategy.

Here’s a step-by-step guide to get you started:

Education and Research

- Understanding Market Trends and Analysis: Get the latest market data, study local real estate trends and analyze location, demand for office buildings or performance of retail properties. Stay informed to find the best opportunities.

- Network with Commercial Real Estate Industry Professionals: Connect with brokers, property managers and other commercial real estate professionals to get insights, access to resources and find the most happening investment opportunities.

Building a Team of Experts

- Real Estate Agents, Attorneys, Accountants and Property Managers: Surround yourself with a team of experts that includes realtors for finding properties, attorneys for legal compliance, accountants for financial oversight and managers for day-to-day property management.

Securing Financing

- Traditional Loans, Private Equity and Crowdfunding: Look into financing options like commercial mortgages, private investors or platforms that offer crowdfunding for CRE real estate projects. Each has its pros and cons so choose what fits your goals.

Due Diligence

- Property Inspection and Risk Assessment: Conduct thorough research on potential investments, from property condition and income potential to tenant quality and market conditions.

Now that you’re set for your commercial property investment journey, you’re ready to face the challenges and seize the opportunities.

But you can be better prepared if you equip yourself with the best CRE software for your workflows.

Partner with Blooma for Your CRE Real Estate Needs

Investing in commercial real estate can be a game changer for growth and diversification, but it can be complicated without the right partner.

The Blooma platform has the expertise and resources to guide you through it all.

- Blooma’s CRE Expertise: With deep industry knowledge and technology, Blooma makes CRE real estate investment easy, so you can make informed decisions with data-driven insights.

- Customized Investment Strategies: Blooma works with clients to create customized investment plans that fit your goals, whether you’re looking at office buildings, multifamily properties or niche asset classes like data centers or industrial buildings.

- Full Property Management: From tenant acquisition to property management, Blooma makes sure your properties are cash flowing, hassle-free, and maximizing returns.

- Exclusive Deals: Access commercial property opportunities and insider information that will set you apart in the commercial real estate game.

Does that sound about right to you?

Then, it’s on to the next step for your company: contact us today!

Get started on your CRE investment journey with Blooma by booking a demo and seeing how we can help you achieve your investment goals.

Start building your future with Blooma—where opportunity meets innovation.