Unlocking the Power of Cap Rates: A Guide to Smarter Commercial Real Estate Investments

If you're interested in commercial real estate investments, capitalization rates or cap rates are one of the metrics you must understand. This guide...

Discover how CRE analysis software like Blooma can empower real estate investors to make data-driven decisions, optimize performance, and mitigate risks.

Investing in commercial real estate (CRE) requires more than gut instinct.

It requires strong data analysis, strategic thinking, and resource management. The commercial real estate industry is constantly changing, so informed decision making is more than a competitive advantage. It’s a necessity.

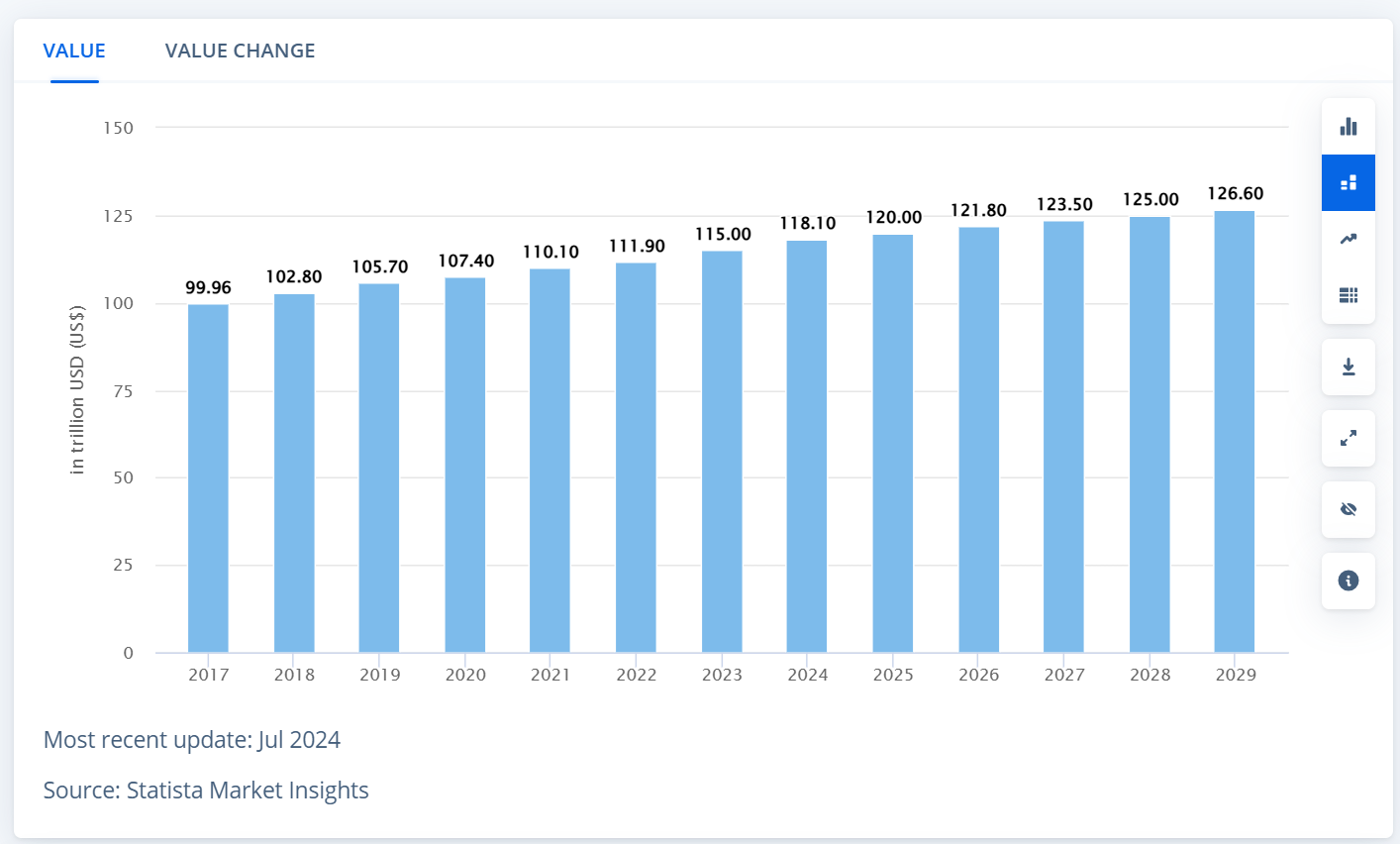

Did you know that according to IBISWorld, the US commercial real estate market is worth over $1 trillion? This offers so many opportunities for real estate investors, but also many challenges.

Source: Statista

Commercial real estate analysis software bridges the gap between traditional methods and real-time insights so real estate investors can optimize their strategies, increase cash flow, and get the best ROI.

In this article, we’ll review real estate investment software in modern CRE management, what makes CRE analysis tools must-haves, and how platforms like Blooma are changing the commercial real estate industry for investors, commercial real estate brokers, and property managers.

Read on to see how technology can transform your CRE journey!

Commercial real estate analysis is the process of evaluating commercial properties to determine their potential profitability, risks, and long-term value. This involves looking at financial data, market trends, and the specifics of each property to make informed investment decisions.

Market research ensures investments are on trend and robust property valuation is the foundation for investment decisions. Comprehensive CRE analysis is key to long term investment success and risk management.

When doing CRE analysis, certain metrics are key to determining the profitability and risks of an investment:

Technology and AI have changed the commercial real estate game, with tools and software to make and improve CRE analysis. Here’s how:

While CRE analysis is still crucial for making informed investment decisions, traditional methods have big challenges.

Let’s look at the challenges of old school CRE analysis.

Traditional CRE analysis is made up of manual workflows that eat up time and resources. Investors must pull property details, market reports, and financial data from different platforms, resulting in inefficiency.

Building complex financial models is also a lot harder. Accurate projections and scenario analysis requires hours of manual input and calculations, delaying critical decisions.

Manual processes are error prone and can be costly in the commercial real estate investment. Errors in spreadsheets or valuation tools can result in the wrong property appraisals or flawed risk assessment.

Experts might also accidentally leave out critical factors. Market leasing assumptions or renewal probabilities might be overlooked without proper analytical tools, skewing the analysis.

The commercial real estate market is fast paced and traditional methods simply cannot keep up.

Without real-time updates, investors may base decisions on old information, missing opportunities or making bad investments.

To overcome these challenges, we need to adopt modern solutions like real estate analysis software that streamline workflows, reduce errors, and give you real-time insights.

Benefits of Using Commercial Real Estate Analysis Software

Modern commercial real estate analysis software is changing how investors and professionals deal with the industry. By automating processes and giving you advanced insights, you can make better, faster, and more informed decisions.

Here are some of the benefits to be aware of.

Traditional methods involve pulling information from multiple sources and are often time-consuming and error-prone. CRE analysis software makes it easy by using:

Modeling is a big part of commercial real estate investing and software makes it easier.

With CRE software, you can build and analyze complex scenarios that create detailed models for cash flow, risk and profit analysis.

Plus, you can take advantage of “what if” analyses to test investment risks and returns. Test different scenarios to see how changes in rents, vacancies, and expenses affect NOI and other metrics.

Having accurate, actionable insights at your fingertips ensures better investment outcomes. You can use the data to drive your strategy. Use the aforementioned metrics like cap rates, DSCR and gross rent multiplier to evaluate opportunities.

Then, find and capitalize on the profits you could tap into. Uncover hidden value in commercial properties and make decisions that match the market.

By automating the mundane, real estate analysis software lets you focus on the important aspects. You can save time and money by automating workflows and reduce the manual work in valuation, reporting, and forecasting.

Focus on the important areas. Spend more time negotiating deals, building relationships and optimizing your real estate portfolio.

Commercial real estate analysis software has advanced features to help real estate investors, property managers and other professionals work smarter and stay ahead of the game.

Let’s take a look at the best ones.

Data from multiple sources is a common problem in real estate analysis. The software solves this by connecting to different data sources. This allows it to pull property data, lease agreements, market trends, and financial information.

Then, you can use it to visualize key metrics. Use dashboards and charts to track performance metrics like cash flow, NOI, and market leasing assumptions.

Financial analysis is key to evaluating opportunities and projecting returns. With CRE analysis software, you can:

Being informed about the market is key to making decisions.

CRE software helps by giving you access to real-time market data that helps monitor trends, pricing, and demand across different regions and asset classes.

You can also use these insights for competitive analysis. Compare commercial properties and see how they stack up in the market today.

Risk mitigation is key to successful real estate investing.

The software comes equipped with risk identification and quantification features that help you analyze data to find weaknesses in property or market performance.

With risk reduction and mitigation strategies, you can make sure you have foolproof methods to reduce your risk and protect returns.

For professionals that manage assets, portfolio tracking is crucial. The software has:

It’s a known fact that commercial real estate analysis can no longer be done manually.

CRE analysis software changes the way real estate investors and professionals make investment decisions.

Blooma is a leader in commercial real estate analysis software, providing tools to simplify and streamline your workflow. With Blooma you can:

Ready to level up your real estate analysis? See how Blooma's real estate software can change your commercial real estate investing business today.

Find out more about our platform and how it fits your needs. You can also see Blooma in action and experience how real estate professionals make decisions with data.

Don’t wait for your competitors to catch up.

Choose Blooma and get ahead in the commercial real estate game.

If you're interested in commercial real estate investments, capitalization rates or cap rates are one of the metrics you must understand. This guide...

Unlock the secrets of cap rate in commercial real estate. Learn how this crucial metric impacts property valuation, profitability, and investment...

This article will cover everything you need to know about CRE property analysis, including its various elements and benefits and what to consider...

Get the latest in CRE intelligence delivered straight to your inbox. From expert insights and market trends to product updates and exclusive tips.