Managing commercial real estate assets has never been more complicated – or more important.

With millions at stake, the matrix of market dynamics, property management and financial strategies can leave even the most experienced real estate asset managers looking for new solutions.

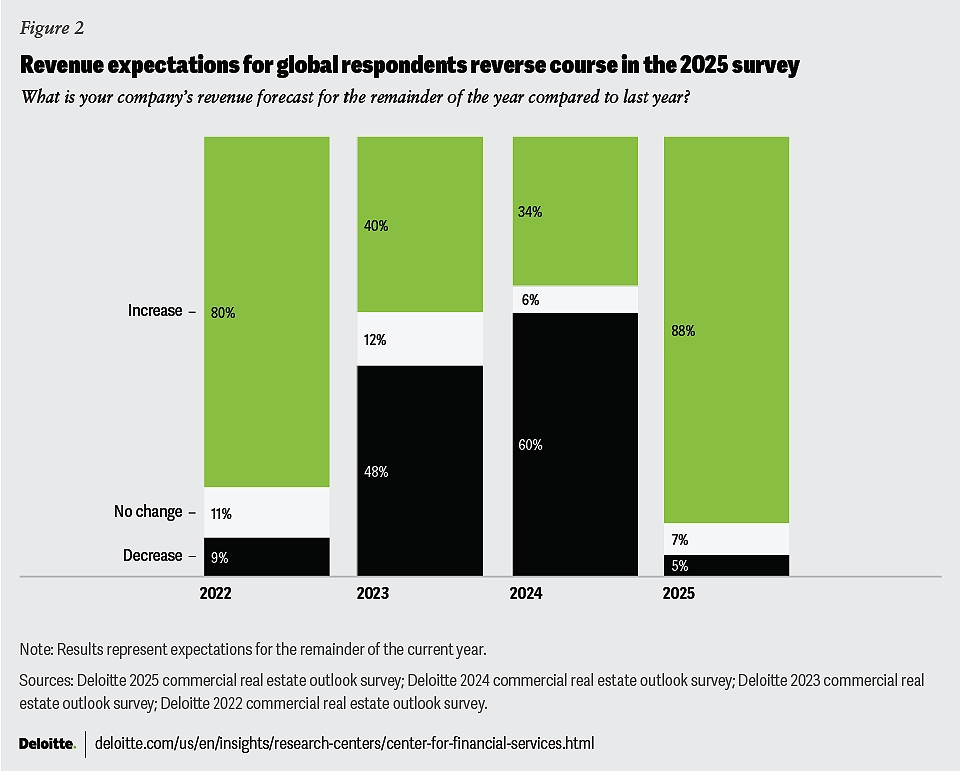

For example, according to Deloitte, 60% of real estate experts expect yearly growth to be in excess of 5% year on year. This means you need strategic and innovative asset management to meet the growing demands.

Commercial real estate asset management is the art and science of getting the most value and profit from investment properties throughout their life. From acquisition to disposition, real estate asset managers are responsible for strategy, risk and financial performance so each property adds to the investor’s portfolio.

But it’s tough. Day to day property management, market fluctuations and increasing operational costs make portfolio management a challenge. Plus, managing risk while increasing cash flow and net operating income requires specialist expertise and tools.

In this article, we’ll look at how modern commercial real estate asset management is changing the industry. If you’re a real estate asset manager, you’ll learn how advanced tools and technology like Blooma’s platform can operate and help you make decisions plus how to get the most from your property and portfolio in a competitive market.

The Evolving Landscape of CRE Asset Management

As the commercial real estate investing market moves at pace with technology and market shifts, real estate asset and property managers need to adopt new tools and strategies to stay ahead of their investment strategies.

From real-time data analytics to sustainable practices, the role of asset management is evolving to meet the modern demands of the real estate market while solving the old problems.

Let’s look at how this is shaping the future of CRE asset management.

Traditional Methods vs. Modern Approaches

Traditional commercial real estate asset management used to rely on manual processes, static spreadsheets, and fragmented communication systems.

While these methods provided a base for managing real estate portfolios, they had big limitations:

- Data Silos: Information was often scattered across different platforms, resulting in inefficiencies and delays in decision making.

- Limited Scalability: As real estate portfolios grew, traditional methods struggled to keep up with the complexity of managing multiple properties.

- Human Error: Manual data entry and analysis increased the risk of mistakes, potentially impacting investment returns and property values.

- Reactive Management: The absence of predictive analytics meant asset managers were often responding to issues rather than proactively addressing them.

But modern tech driven approaches have changed real estate asset management by introducing:

- Real Time Data: Live metrics so you can make decisions fast and optimize your investment strategy and financial performance.

- Automation: Automate the mundane tasks like collecting rent, tracking lease agreements, and monitoring expenses so you have more time to plan.

- Predictive Analytics: Use AI to anticipate market movements, mitigate risk and find new opportunities.

- Sustainability Integration: Technology helps with energy efficiency so you can reduce costs and carbon footprint which aligns with investor and tenant requirements.

By moving away from traditional methods to modern approaches, commercial real estate asset managers can be more efficient, more accurate, and stay ahead of the market.

Key Components of Effective CRE Asset Management

CRE asset management is a holistic approach, strategy, technology and attention to detail.

Here are the key components to know:

- Risk Assessment and Mitigating Risks: Risk management is at the heart of real estate asset management. From market conditions to insurance strategies, real estate asset managers must proactively manage the risks that can impact property value, investment returns or day to day operations.

- Property Performance Tracking: Tracking commercial real estate assets is key to their profitability. This means monitoring cash flow, net operating income, and operational expenses so each asset is contributing positively to the overall investment portfolio.

- Financial Analysis and Reporting: Detailed financial analysis gives you insight into the asset’s profitability and future potential. Generate reports on financial projections, operating expenses, and market value so you can make informed decisions that align with investor financial strategy and investment goals.

- Tenant Management: Tenant relationships are key to the property’s profitability. Good property managers focus on building strong tenant relationships, addressing issues quickly and maintaining high occupancy to maximise returns on commercial real estate investments.

- Lease Administration: Lease management is critical to compliance and rental income. This means tracking lease terms, renewals, and escalations to avoid revenue leakage and steady cash flow.

- Property Valuation: Property valuation is key to understanding the asset’s current market position and future growth. By considering capital improvements, market trends, and local market dynamics managers can make strategic decisions to increase property value and maximize long term returns.

How Advanced Technology Can Mitigate Risk in CRE Asset Management

Technology plays a big part in staying ahead of the risks which is key to ensuring property value and investment returns. Here’s how you can do this.

The Role of AI and Machine Learning

Artificial Intelligence (AI) and machine learning are changing the way we assess and mitigate risk in real estate asset management in the following ways:

- Data Analysis and Trend Identification: AI can process huge amounts of data, market trends, financials, and tenant behaviour to identify risks before they become problems.

- Predictive Analytics: Machine learning models can find patterns in historical data to predict future issues, such as tenant defaults or market downturns, so you can act proactively.

Real-Time Monitoring and Alert Systems

Time is of the essence to minimize risk and resolve operational issues.

- Real-Time Data: Advanced systems provide live feeds on key metrics like occupancy rates, cash flows, and maintenance requirements so asset managers have a complete view of their real estate portfolios at all times.

- Automated Alerts: Real-time alerts flag issues like late rent payments, sudden increases in operating expenses, or changes in market conditions so we can act quickly to protect property values and investment returns.

Streamlined Workflow and Automation

Automation frees up time from repetitive tasks so real estate asset managers can focus on decision making. Take advantage of automation to unlock:

- Routine Task Automation: Technology simplifies tasks like collecting rent, tracking lease agreements, and generating financial reports. In the long run, this reduces manual errors and improves productivity.

- Increased Efficiency: Automation ensures compliance, improves tenant satisfaction, and reduces operational costs so overall financial performance improves.

Commercial Real Estate Asset Management: How Can You Mitigate Risk in a Complex Market?

Risk management is one of the biggest challenges asset managers face.

Loan default risk and property valuation uncertainty are two of the biggest concerns which can impact investment returns and real estate portfolios.

Here’s how Blooma’s technology tackles these challenges.

Loan Default Risk: Predicting and Preventing Issues Early

Loan defaults are a big concern for many asset managers as they impact cash flow and overall financial performance.

Blooma’s AI and machine learning can help mitigate this risk:

- Predictive Loan Risk Analysis: Blooma’s platform analyzes historical loan performance data and real-time market data to predict potential default risks. This proactive approach allows asset managers to act before defaults happen.

- Custom Risk Scoring: With custom risk profiles, Blooma provides a score for each loan so asset managers can focus and allocate resources more effectively.

Property Valuation Uncertainty: Navigating Volatile Market Conditions

Property valuation is key to maintaining property value and fair pricing during acquisition or disposal. Market volatility makes this harder. But with Blooma, you can take advantage of:

- Real-Time Market Data: Blooma has real time data on local and national market conditions so real estate asset managers can see the true value of a property.

- AI Powered Valuation Models: Blooma uses AI to give precise property valuations that take into account location, amenities and recent sales, so you don’t have to guess.

With Blooma on your side, real estate asset managers can navigate the complexities with ease and manage risks better while refining their real estate portfolio management.

The Future of CRE Asset Management with Blooma

The commercial real estate industry is changing fast and real estate asset management needs a modern approach to deal with risks, accurate property valuation and operational efficiency.

Blooma’s platform combines AI, machine learning, and real time data to help real estate asset managers:

- make informed decisions

- improve returns

- optimize real estate portfolios

Don’t be held back by the old ways.

See how Blooma can help you transform your commercial real estate asset management. Visit our website to find out more and book a demo today.

With Blooma under your wings, you can get ahead of the game, turn challenges into opportunities, and build more efficient data driven real estate asset management.