Optimize Your Loan Origination in CRE

Do you want to maximize efficiency and success in CRE lending with optimized loan origination processes? Discover how to streamline workflows and...

Curious about how top loan origination software is transforming CRE lending? Learn how Blooma can revamp your CRE lending strategy with its advanced tools.

In the fast-paced, ultra-competitive world of commercial real estate (CRE) lending, survival of the fittest is no joke. To stay ahead of the pack, lenders and financial institutions who think smart are adopting cutting-edge commercial loan origination and lending software.

These advanced systems aren’t just shiny new toys to add to your back-office’s repertoire of tech. They’re game-changing cloud-based tools that can transform your functionality and workflows, processes, and profitability.

In fact, the benefits of adopting advanced loan origination systems (LOS) are significant. Imagine a world where loan origination is a breeze, costs are slashed, and customer experience is top-notch.

That’s the power of today’s best loan origination software: Blooma.

In this article, we will review how using loan origination software can revamp your CRE lending processes, boost profitability, and enhance customer experience.

We’ll also touch upon how Blooma fits into this picture and why you shouldn’t miss out on its benefits.

Let’s dive into the key pillars that define state-of-the-art commercial loan origination software and how they address the unique needs of CRE professionals.

Do you ever see your loan origination process as a raging river, full of potential pitfalls and obstacles? What if we told you that you could use automation to create a calm and seamless flow?

That’s precisely what leading loan origination software does, transforming your workflows from rocky rapids to a smooth, steady stream.

With automation, you can say goodbye to the repetitive, mundane tasks that eat up your precious time and energy. From data entry to document management and processing, these algorithms and bots handle it for you.

Faster turnaround times, minimal errors, and regulatory and compliance standards met — automation is your secret weapon to conquer loan origination with finesse.

Artificial intelligence (AI) and machine learning (ML) analytics are game-changers in the realm of SaaS-based commercial lending.

No longer must lenders rely on traditional analysis alone to gauge borrower profiles, market trends, and potential risks. AI-driven analytics dive deep into oceans of data, surfacing critical insights that would otherwise remain hidden while still focusing on connectivity.

With these powerful tools, underwriting becomes a science of accuracy and efficiency. Risks are accurately predicted, credit risk management is optimized, and profitability soars.

Data integration is the super glue holding top loan origination software (LOS) systems together.

With seamless integration capabilities, LOS connects effortlessly with CRM, financial databases, and third-party apps, providing a 360-degree view of each loan application.

This data harmony translates to greater efficiency, accuracy, and a streamlined workflow – origination to servicing, just like that.

Lenders can now sit back and enjoy the benefits of a unified data ecosystem, where relevant information flows freely and effortlessly, giving them the power to make informed decisions with lightning-fast speed.

Now that you know the benefits, let’s go over some of the most common obstacles faced in the traditional setup.

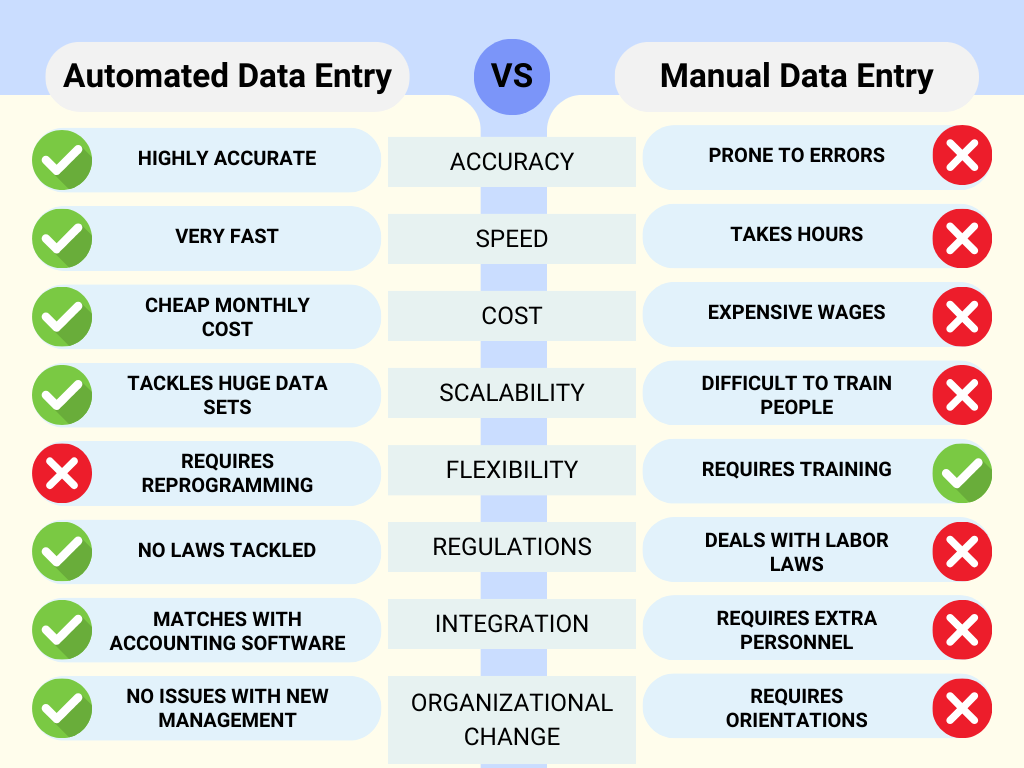

In the age of automation, manual data entry remains a stubborn holdout in traditional CRE loan origination.

Source: DocuClipper

Inputting vast amounts of information manually drains time and resources and is prone to errors.

With every keystroke, the potential for mistakes increases, leading to inaccurate assessments, delayed loan approvals, and, ultimately, a less efficient and reliable lending process.

Time is money, and in commercial real estate, every second counts. The cumbersome and antiquated manual processes of traditional CRE loan origination can lead to snail-like processing times.

With each painstaking step, from gathering paperwork to manually verifying data, borrowers grow impatient, and opportunities slip through the cracks, putting lenders at a serious disadvantage in today’s fast-paced marketplace.

Human judgment may be invaluable in many situations, but in the intricate world of commercial real estate loan origination, it can sometimes prove disastrous.

Manual calculations and subjective judgments can result in flawed loan assessments, ranging from miscalculations of loan-to-value ratios to missed credit risk factors and lines of credit.

These seemingly small inaccuracies can snowball into disastrous consequences for lenders, such as poor lending decisions, increased default rates, and devastating financial losses.

Blooma is a trailblazing commercial loan origination software that revolutionizes the world of CRE lending.

With its sophisticated technology, intuitive design, and comprehensive capabilities, Blooma is the tool that helps professionals navigate the complex currents of commercial lending with confidence and precision.

Here’s how.

Gone are the days of tedious manual processes and slow workflows.

Blooma’s innovative automation capabilities take the heavy lifting out of CRE loan origination, allowing professionals to breeze through applications and approvals with unprecedented speed and efficiency.

By eliminating manual data entry, expediting paperwork processing, and streamlining workflows, Blooma revolutionizes the borrowing experience for all parties, delivering satisfaction and a competitive edge.

Blooma’s advanced AI analytics engine scrutinizes large volumes of data with the utmost care, ensuring that every loan application is analyzed with pinpoint accuracy.

By minimizing the risk of human error, Blooma gives lenders the confidence they need to make sound credit decisions.

With data-driven insights guiding every step, lenders can trust that their loan portfolio is protected against potential pitfalls.

Successful players in the CRE industry need more than just speed and precision. They need foresight.

Blooma’s real-time data integration and predictive analytics give CRE professionals the tools to anticipate market shifts, uncover profitable opportunities, and mitigate risks.

This powerful combination of data integration and advanced analytics equips lenders with a comprehensive view of the market and borrower profiles, allowing them to make strategic decisions that drive profitability and secure a competitive edge.

Blooma’s unwavering commitment to excellence forms the foundation of its approach, ensuring it stays at the forefront of the industry with continual technological advancements.

From SMEs to credit unions to large financial institutions, Blooma’s customizable features and seamless integrations cater to diverse needs, creating a personalized lending experience for every client.

Integrating Blooma into your operations unlocks these and many more benefits, revolutionizing the way you manage your CRE lending business and partnerships through a single platform.

The world of CRE lending has a lot of risks — some obvious, some more subtle and hidden.

This is where Blooma’s intelligent risk loan management tools come into play.

Across commercial real estate, digital lending, and even other financial services in commercial banking, identifying risks early can be the difference between a lucrative deal and a costly mistake.

Blooma’s cutting-edge AI and machine learning algorithms dive deep into vast pools of data, surfacing potential red flags that might otherwise go unnoticed in traditional methods.

By flagging borrower credit history, financial statement, and market trend anomalies in real-time, Blooma equips lenders with the ability to address risks proactively, safeguarding their loan portfolio and mitigating future pitfalls.

When risks arise in commercial real estate lending, decisive action is crucial.

Blooma’s detailed risk assessments and strategic recommendations guide lenders through the decision-making process, enabling them to proactively manage their loan portfolios.

For example, if a borrower’s credit score is less than ideal, Blooma may suggest increasing collateral or down payment to offset potential losses.

With Blooma’s tailored solutions, lenders can carefully balance their exposure to risk, ensuring that their portfolios remain healthy and profitable.

In the unpredictable world of commercial real estate lending, staying on top of risk requires constant vigilance.

Blooma provides real-time updates and continuous risk assessments to ensure lenders are always informed and ready to pivot their strategies when markets shift, or borrower circumstances change.

This approach keeps you one step ahead of potential pitfalls, enabling you to confidently navigate uncertain waters and steer your loan portfolios toward success.

The comprehensive data analysis and actionable insights provided by Blooma reduce uncertainty and enhance the overall decision-making process.

The result?

Loans that stand the test of time, portfolios that are skillfully managed, and ultimately, higher profitability for lenders who rely on data-driven decisions.

Here are some tips and best practices to ensure a smooth transition to Blooma.

Blooma’s commercial loan origination solution is designed to transform the way you manage your lending operations, offering a powerful suite of tools that streamline workflows, mitigate risks, and accelerate loan processing times.

By integrating AI-driven analytics, seamless data integration, and strong risk management capabilities, Blooma gives you the power to forge your CRE journey paired with higher profitability.

So what are you waiting for?

It’s time to level up your lending operations with Blooma.

See Blooma’s lending platform in action by scheduling a personalized demo with our team.

Don’t wait to future-proof your CRE lending strategy.

Take the first step towards a more efficient, accurate, and innovative lending process with Blooma today!

Do you want to maximize efficiency and success in CRE lending with optimized loan origination processes? Discover how to streamline workflows and...

Discover how embracing commercial loan automation can revolutionize your commercial real estate (CRE) lending and allow you to stay competitive in...

Discover how underwriting software like Blooma can revolutionize CRE lending. Unlock the full potential of your lending operations with advanced...

Get the latest in CRE intelligence delivered straight to your inbox. From expert insights and market trends to product updates and exclusive tips.