What is Commercial Underwriting?

In a nutshell, commercial underwriting is the process of assessing and quantifying the risk of lending to businesses or insuring policies. It’s a big part of both the insurance industry and commercial lending, where underwriters decide to approve applications, set policy terms and determine premium rates or loan conditions.

Traditional underwriting involves manual reviews, risk assessment and analysis of financial data, which takes time and expertise. Underwriters use a lot of information to assess creditworthiness, market conditions, and uncertainty in business operations. But this manual process can lead to delays, inefficiencies and inconsistencies, making it hard to keep up with the demands of modern lenders and clients.

A recent survey showed that businesses using automated solutions, like AI-powered data analytics, can see up to a 40% increase in data accuracy. There’s no doubt that technology is changing the commercial underwriting landscape.

In this article, we will review both the traditional and AI-enhanced underwriting processes, their challenges, and how AI-driven solutions like Blooma’s CRE software are transforming the industry for underwriters, lenders, and businesses.

Challenges in Traditional Commercial Underwriting

Traditional commercial underwriting processes, while forming the foundation of the insurance and lending industries, have several challenges that can impede efficiency and accuracy.

As industries evolve, addressing these challenges is crucial to stay competitive and meet modern business demands.

Let’s take a look at the common challenges underwriters and businesses face:

Subjectivity and Bias

Human judgment is a big part of traditional underwriting, sometimes leading to inconsistent risk assessment.

Personal biases and subjective interpretation can result in uneven evaluations and ultimately the wrong underwriting decisions and policy terms being created.

Time-Consuming

Manual process involves extensive review and data collection, which takes up a lot of time.

For lenders and clients, this means longer wait time to get loans or coverage, which can hinder business operations and growth.

Limited Data Analysis

Traditional methods are limited in their ability to process and analyze a large volume of data, which also limits the ability to uncover complex patterns and correlations.

This drawback can result in underwriters missing important insights that can improve risk management and premium accuracy.

Increased Risk

Manual processes increase the risk of human error, like overlooking important details or applying underwriting criteria inconsistently.

These errors can expose lenders or insurers to financial risk and regulatory non-compliance.

How AI Transforms Commercial Underwriting

AI in commercial underwriting is changing several processes, addressing the more traditional challenges, and opening up new opportunities for speed, accuracy and scalability.

By changing how commercial underwriting is done, AI allows underwriters to deliver better results in a fast-paced, data-driven business.

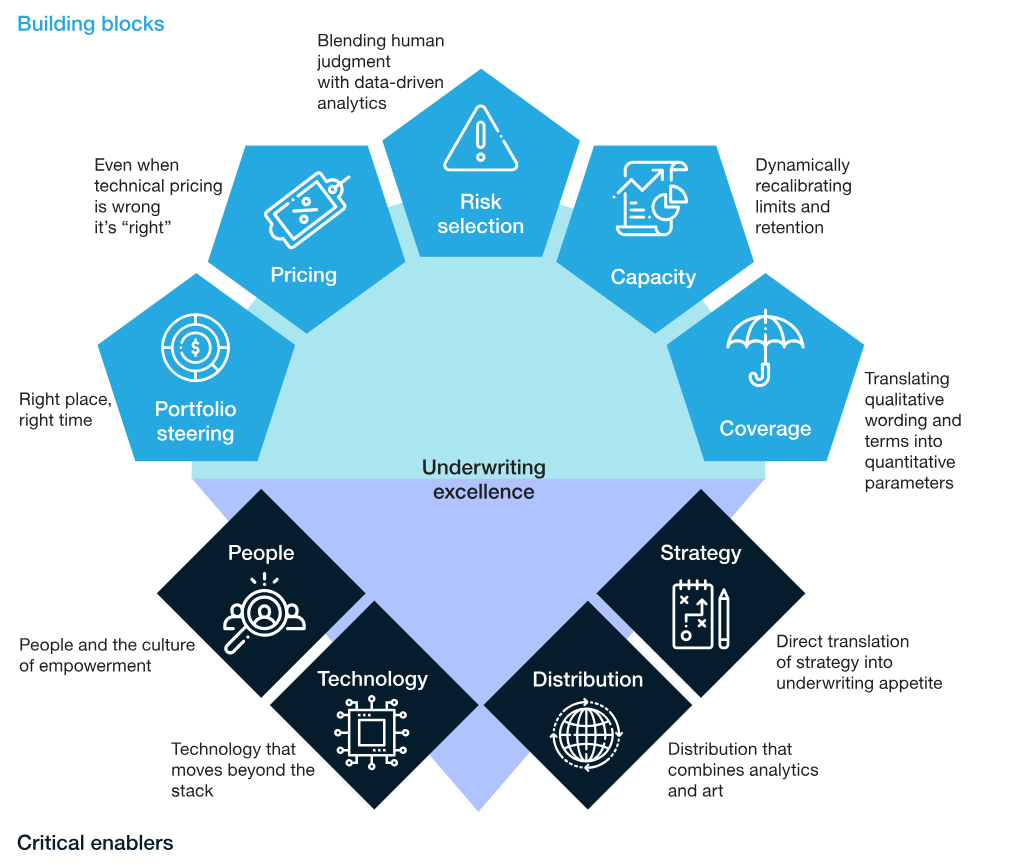

Source: McKinsey

Here’s how:

Automation of Routine Tasks

AI is great at automating mundane and time-consuming tasks like data entry, document verification, and file organization.

By taking care of these routine tasks, underwriters can focus on the more complex aspects of risk assessment and decision-making.

This automation saves time, increases productivity, and allows professionals to process more applications in less time.

Enhanced Risk Assessment

AI algorithms can analyze vast amounts of data from multiple sources and find patterns and correlations that humans miss.

This extra analysis allows underwriters to:

- Make precise property valuations.

- Conduct in-depth tenant analysis for commercial properties.

- Carry out market risk assessments using historical trends and predictive modelling.

By identifying risks earlier and more accurately, AI helps lenders and insurers reduce uncertainty.

Improved Consistency and Accuracy

One of the biggest advantages of AI is that it removes human bias from the underwriting process.

AI applies underwriting guidelines to every case, so it’s fair and objective.

Automated systems also reduce the risk of human error so risk assessments and underwriting decisions are more accurate.

Faster Decision-Making

The underwriting process is streamlined with AI tools, so approvals are faster and have better outcomes. Lenders and borrowers get quicker turnarounds so more applications can be processed.

Key Features and Benefits of Blooma’s AI-Powered Underwriting Solution

Blooma’s platform is changing commercial underwriting with technology that simplifies, improves accuracy, and delivers insights.

Here’s what sets Blooma apart:

Automated Data Extraction and Analysis

Blooma uses algorithms to automatically extract key data from loan applications, financial documents and other relevant sources.

This reduces the time and effort spent on manual data analysis so underwriters can focus on the important stuff.

Predictive Risk Modeling

At the core of Blooma’s platform is machine learning technology for risk assessment.

These models analyze huge datasets to find trends, predict risks, and provide recommendations.

Whether property performance or market fluctuations, Blooma’s predictive tools help with underwriting decisions.

Real-Time Insights and Reporting

Blooma has real-time dashboards and analytics so professionals can view loan portfolios live.

This allows lenders to see performance metrics, opportunities, and get the best idea of what to do next.

Integration with Existing Lending Platforms

Blooma is designed to plug in to existing systems, property management tools, and loan processing software.

This means no workflow disruptions and underwriters can use their existing tools with AI added.

Quantifiable Results with Blooma

Blooma’s AI-powered solution delivers measurable improvements across the underwriting lifecycle.

By simplifying workflows, reducing human errors, and giving you added insights, Blooma lets you underwrite with confidence, make faster decisions, and grow.

Wondering how? Request a case study from us today and find out.

After all, Blooma’s platform is more than a tool—it’s a platform that changes the way commercial underwriting is done.

Underwriting the Future with Blooma

Accurate and efficient commercial underwriting is the foundation of good lending decisions.

In today’s fast-paced underwriting environment, evaluating risks quickly and confidently is more important than ever.

AI is changing the underwriting landscape, bringing speed, precision and consistency to a formerly exclusively manual process.

With Blooma’s platform, your business can get ahead of the competition, reduce uncertainty, and future-proof your lending.

As a pioneer in AI underwriting solutions, Blooma helps lenders and underwriters make better underwriting decisions, simplify workflows and achieve better outcomes for their business and customers.

Want to see for yourself?

Get started with Blooma today to experience the best changes to your business so you can protect your best interests while succeeding in your daily operations!